Huge disparities now exist between countries on the amount of tax they take from businesses, according to UHY, the international accounting and consultancy network.

The tax burden on business profits can be more than three times greater in the highest versus the lowest taxed major countries - highlighting just how wide the tax gap is between 'low tax' emerging economies and the majority of 'high tax' developed nations.

For example, analysing highly profitable businesses (defined as making a pre-tax statutory profit of US$100 million per annum) the difference in the amount of tax collected between the highest taxing country surveyed (Japan) and the lowest taxing (Ireland) is US$29.5 million, which means that the same business in Japan would pay over three times more tax than the equivalent business in Ireland.

According to UHY tax professionals, many countries have been reducing their corporate tax rates in a bid to become more competitive and attract highly mobile multinational businesses. The research highlights the need for some countries to work harder to become more attractive to businesses, which are increasingly mobile and are less constrained by geography than at any time in history.

There are also a number of increasingly important economies, such as Dubai (UAE), that do not charge any corporate tax.

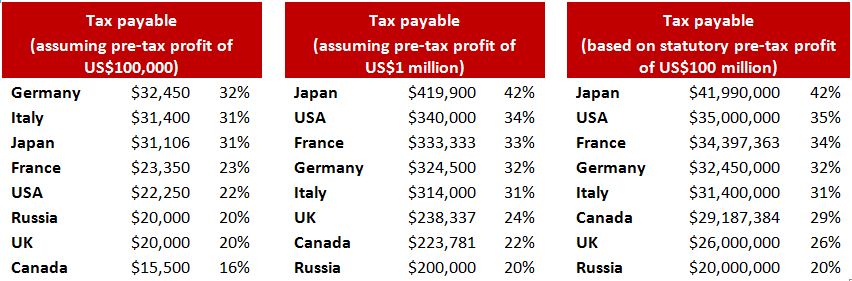

UHY tax professionals studied tax data in 21 countries across its international network, including all members of the G8, as well as key emerging economies. Tax professionals based in each country calculated post-tax profits for businesses making annual statutory pre-tax profits of US$100,000, US$1 million and US$100 million.

The G8 countries

Corporate tax payable per country in US dollars (highest to lowest)

John Wolfgang, chairman of UHY comments: "The difference between countries in the amount of tax they take from business profits is quite staggering. It will shock many business leaders that, among the G8 countries, both the USA and Japan impose higher corporate taxes on some businesses than EU countries like France and Germany, which are traditionally seen as high tax economies."Most non-G8 countries now impose a flat rate of tax regardless of the amount of profit generated. Most of the G8 – the exceptions are Germany, Italy and Russia – have progressive tax models with the effective tax rate increasing with profits. While this allows them to help smaller companies to grow, it does make their tax systems more complex.

"High corporate taxes can deter business investment, which can hinder economic growth. Over the last decade, many EU countries have slashed corporate taxes, leaving some BRIC nations, such as Brazil and India, with surprisingly high tax in comparison."

He adds: "Companies are increasingly mobile and are able to switch tax domicile with relative ease. This has put governments in a quandary, as they seek to boost tax revenues in order to shore up public finances. Many countries have opted to resolve this problem by increasing personal taxes while reducing corporate tax rates. Once a major economy slashes corporate tax rates, however, it puts pressure on others to take similar measures to remain competitive."

Teruo Kawakami, Director of UHY Tax Corporation, member of UHY in Japan, which has the highest corporate tax rate in the G8, says: "A provision to reduce the corporate tax rate had been originally included in 2011 Tax Reform as part of measures to lessen the tax burden on businesses, but this was subsequently set aside. Another tax bill is currently under discussion in the Diet. The effective corporate tax rate of Japan will decrease by approximately 5% when the bill is approved by the Diet."

Alan Farrelly, Partner of UHY Farrelly Dawe White Limited, member of UHY in Ireland - which has one of the lowest corporate tax rates among the countries surveyed - says: "It is unlikely that the low corporate tax rate will rise, despite the need to shore up the public finances in Ireland. The low rate is considered a key strategy to maintaining Ireland's competitiveness in the Eurozone, especially given the ongoing economic climate in the EU. Ireland’s strategy could be viewed as a test against which other economies will assess themselves when providing a response to the economic crisis."

Diego Moreira, technical director of UHY Moreira-Auditores in Brazil, member of UHY, comments: "Brazil’s corporate tax rate is substantially higher than any other BRIC nation (Brazil, Russia, India and China). It is also higher than most developed nations, which is surprising. Perhaps a more competitive tax rate would help attract more international businesses to re-domicile in Brazil."

UHY's research reveals that (excluding Dubai and Estonia, which do not tax profits at all), for business with profits of US$100,000 per annum, the difference in the amount of tax collected between the highest taxing country (Brazil) and the lowest taxing (Ireland) is US$21,500, which means that a business in Brazil would pay nearly three times more tax on its profits than the equivalent business in Ireland.

All 21 UHY countries surveyed

Corporate tax payable per country in US dollars (highest to lowest)

* For Italy the reported tax rate has been determined making some simplified assumptions; effective tax rate may be higher than the theoretical one indicated above.

The calculations assume all exceptional gains and costs have been taken into consideration, as well as things like interest, the cost of stock options and goodwill amortisation. The tables (above) rank countries from the highest tax burden first to the lowest tax burden last.