Western governments have been trying to boost bank lending, especially to small and medium-sized businesses (SMEs), ever since the 2008 collapse of Lehman Brothers in the US — while banks have been resisting, looking to repair their balance sheets by reducing their loan books.

The reluctance of Western banks to lend — under pressure to shore up their capital wealth and for being too easy-going with their lending in the past – has been a key factor inhibiting economic growth in many Western nations.

In parts of Europe, in particular, bank lending on a tight leash has slowed investment and innovation by companies, especially SMEs, and stifled confidence in employee recruitment.

Whereas, by comparison, in the US more than 15,000 financial institutions lend to SMEs, in the UK, for example, five dominant lenders control about 90% of the market for loans to companies of this size. These high street banks, because of their ambitious lending targets of the ‘glory days’, have been instructed to reduce their balance sheets and lend less.

As a result, SMEs have become less reliant on banks and are looking for other forms of funding, such as asset finance or invoice discounting. Capital is also available from private equity sources. SMEs in the UK, known for their determination to overcome obstacles, are also using their own funds, and funds from friends and family. According to the UK’s Federation of Small Businesses, entrepreneurs are using their own personal credit cards as much as they are using secured lending facilities from banks.

Given that the 4.5m SMEs in the UK account for 59% of private sector employment and 49% of private sector turnover, the sector should receive more loan capital than it is getting, says Odhran Dodd, corporate finance partner at UHY Hacker Young in London, UK.

The Bank of England’s Trends in Lending report, released in April 2012, showed that there was a contraction in the loan stock in the UK for SMEs by about GBP 9 billion in the three months from February 2012, but that credit availability was largely unchanged.

"However, some UK lenders have noted that demand from SMEs is muted, possibly due to the loss in credibility and confidence," says Dodd.

The banks have also fallen short of their 2011 Project Merlin commitments by lending GBP 1.1 billion less to SMEs than they had targeted.

The UK’s coalition government is trying to overcome this with a new development fund focusing on lending GBP 1-10 million to SMEs as "it now realises that the SME sector is the driver of the economy and is ironically being starved of capital", says Dodd. "How this progresses remains to be seen, but the feeling in the market is one of cynical scepticism."

Where a company manages to secure a bank loan, providing the amount of data now required by the banks is a time-consuming and arduous task for entrepreneurs which distracts them from focussing on building their businesses, says Dodd.

Moreover, while the Bank of England base rate remains low, for those SMEs securing funding from a high street bank, the bank fees are higher than previously, with margins of between 2-4% and fees of a similar size. And the amount of time it takes to secure this lending is elongated and frustrating, causing SMEs to look elsewhere for sources of capital.

Emerging nation development

Meanwhile, the BRIC countries march on, leaving Europe in their wake. The extent of bank lending among global economies demonstrates how the pivotal balance of the world economy is tipping in favour of key emerging nations.

A UHY global study shows that Brazil, Russia, India and China (BRIC nations) have increased their bank lending to businesses by double digits since the collapse of Lehman Brothers.

By comparison, the US economy, and many European economies, have seen bank lending fall by double digits, threatening their economic recovery.

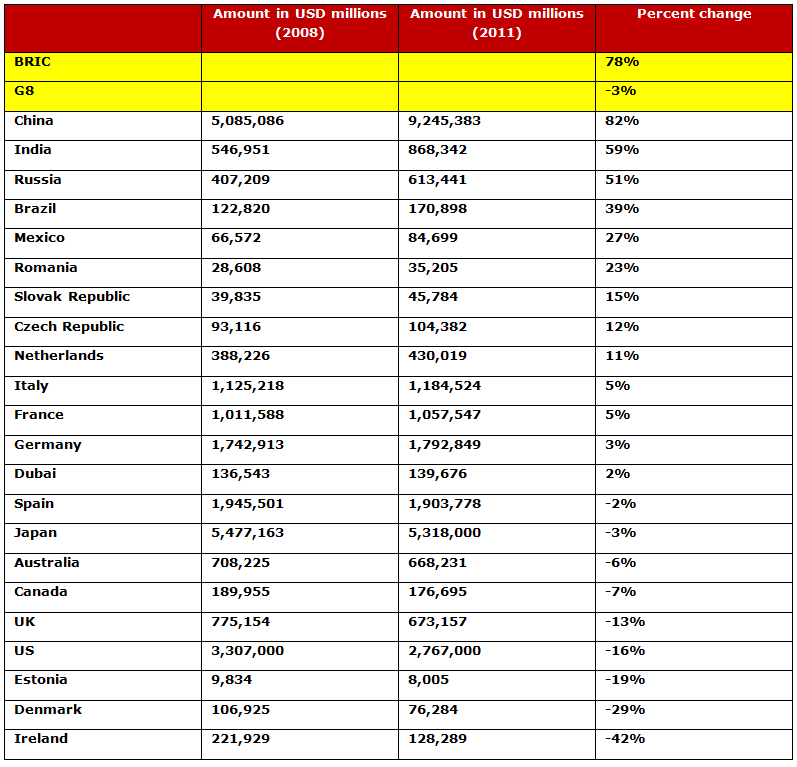

The research shows that BRIC banks have, on average, increased lending to businesses by 78% since December 2008, compared to banks in the G8 nations which have, on average, decreased funding to businesses by 3% over the same period.

The country with the fastest increase in loans to businesses is China, where the amount of debt held by businesses has increased by 82% since the onset of the credit crunch. Chinese banks have approximately USD 9.2 trillion in outstanding loans with businesses, compared to USD 5 trillion in December 2008.

The country which has seen the largest reduction in the value of loans to businesses is Ireland — down by 42% since December 2008 from around USD 222 billion to USD 128 billion.

UHY's findings derived from an analysis of Central Bank data on outstanding loans to businesses in 22 countries across its international network, including the G8 and key emerging economies. Resultant bank lending trends are shown in the table below.

Increase/decrease in loans to businesses (2008-11)

"The difference between the US and Europe on the one hand and the BRIC nations on the other is stark," says UHY chairman John Wolfgang.

"The four BRIC nations have seen their lending to businesses grow at the fastest rate, while among the G8, only Russia has seen a real-terms increase in business lending over the last five years.

"Lending to businesses, particularly small businesses, is seen as a key barometer of economic prosperity. Small businesses are the engine of growth for most economies, but starved of fuel in the form of credit it can be difficult for them to expand and create jobs.

"In an increasingly globalised world, if a small business cannot expand to fulfil an order, that business can be lost to a better-financed overseas competitor."

Small businesses, says Wolfgang, are hugely reliant on bank financing as, unlike larger corporates, they are usually not able to raise money through bonds or share issues.

Despite the overall contrast between lending in emerging and economically established regions, the research pinpoints that some established EU economies — Romania, Czech Republic, Slovak Republic, the Netherlands, Italy, France and Germany – have posted a significant increase in lending to businesses, despite the impact of the Eurozone crisis on the liquidity of European banks.

"The pace of deleveraging among many European banks — in comparison with American, British and Irish banks – has been painfully slow," says Wolfgang. "This probably explains why lending to businesses in countries like Italy and France has increased, albeit not in real terms.

"The deleveraging process in Europe, when it begins in earnest, will almost certainly result in a contraction in lending to businesses, which will impact economic growth. In the US, the UK and Ireland, where that process has been ongoing for several years, the ability of small businesses to access funding has become a major political issue."

Russia — the nation posting a growth in lending to businesses out of step with the rest of the G8 — has been insulated from the full force of the global financial crisis by a commodities boom, says Nikolay Litvinov, of UHY’s firm in Russia, UHY Yans-Audit LLC.

"The Russian economy, though suffering a financial crisis in 2008/09, has recovered quite strongly since then," he says. "This has fuelled appetite for debt among Russian businesses and enabled well-capitalised Russian banks to meet that demand."

By comparison, Ireland is at the bottom of the league in the bank lending survey. Alan Farrelly, of UHY's firm in Ireland, UHY Farrelly Dawe White Limited, says: "The Irish government has pumped more than EUR 60 billion into the banking system over the last four years. The purpose of this money was to save the banks from collapse, but now that the immediate crisis has been averted, the Government needs to ensure that more of this money finds its way into the economy.

"Effects of the 42% reduction in bank lending are seen in Ireland’s economic fortunes. SMEs are struggling to survive with the lack of cashflow lending in Ireland. The Government now have sizeable stakes in the Irish banks and they must exert influence to encourage the banks to lend to stimulate activity in the Irish economy," says Farrelly.

Also near the bottom of the league is Denmark. Bo Langmann, of UHY’s firm in Denmark, INFO:REVISION A/S, says it is clearly noticeable that banks are reducing their balance sheets.

"It affects the small- and medium-sized enterprises’ possibility of obtaining finance — and especially enterprises that earn the main part of their revenue in Denmark — for example, contractor enterprises, the retail sector, the restaurant industry, etc. They have all been hit."

Furthermore, he says, in recent years, the banks have increased their margin considerably to now 3-8% for the small enterprises which, combined with the banks’ reduction of their balance sheets, prevents the enterprises from embarking on new investments.

"Politically, the problems have come into focus, especially with respect to the low investment level," says Langmann, "and, accordingly, we expect to see legislation during 2012 which will stimulate interest in investing."

At the top of the bank lending league, China is fast positioning itself as a global economic superpower. Wilson Lu, of UHY’s firm in China, ZhongHua CPAs, says: "Bank lending growth has accelerated remarkably since late 2008 — to emerging strategic industries and the modern services sector, as well as to recycling and low-carbon industries. Together with increased financial support for small enterprises and credit expansion, they have all contributed to the strong recovery of China's economy."

But strong bank lending cannot always be taken as a barometer of economic development. In the case of Romania — sixth in the league table — the banks are regretting their enthusiastic lending strategy now that financial stimulus has not been translated into business development and borrowers have started to default on repayments: so much so that bank lending since the survey has been scaled back significantly, says Mihaela Mocanu, of UHY's firm in Romania, UHY Audit CD.

More tightly controlled lending may well have been a preferable way forward in Romania — a cautionary tale for those blaming the banks for restricted lending elsewhere in Europe. But… while Europe dithers and woefully contemplates its plight, the developing world powers ahead, continuing to develop apace.

Contact: Nikolay Litvinov

Email: n.litvinov@uhy-yans.ru

Contact: Alan Farrelly

Email: alanfarrelly@fdw.ie

Contact: Wilson Lu

Email: youyi_lu@zhonghuacpa.com

Contact: Odhran Dodd

Email: o.dodd@uhy-uk.com

Contact: Bo Langmann

Email: bl@info-revision.dk

Contact: Mihaela Mocanu

Email: mihaela.mocanu@uhy-ro.com