Eastern Europe and emerging economies offer most generous tax regimes for higher earners

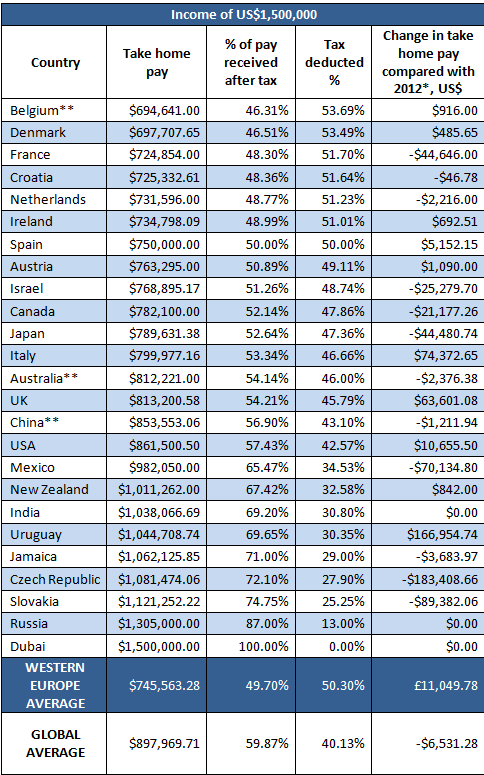

Western European economies* hit their highest earners with 25% more in tax than the global average, amounting to just over US$152,406 extra in tax on an income of US$1.5million, according to a new study by UHY, the international accountancy network.

The research reveals that the global average take home pay on earnings of US$1.5million is US$897,970 with tax at 40%. Taxpayers in Western European economies with the same earnings however, are allowed to take home only an average of US$745,563, paying 50% of their income in tax.

UHY points out that the highest earning taxpayers in Western Europe also face a far bigger tax bill than peers in other developed nations. In Western Europe, taxpayers with a gross income of US$1.5million would keep an average of 50% of earnings, compared to an average of 57% in Canada, the USA, Japan, New Zealand and Australia.

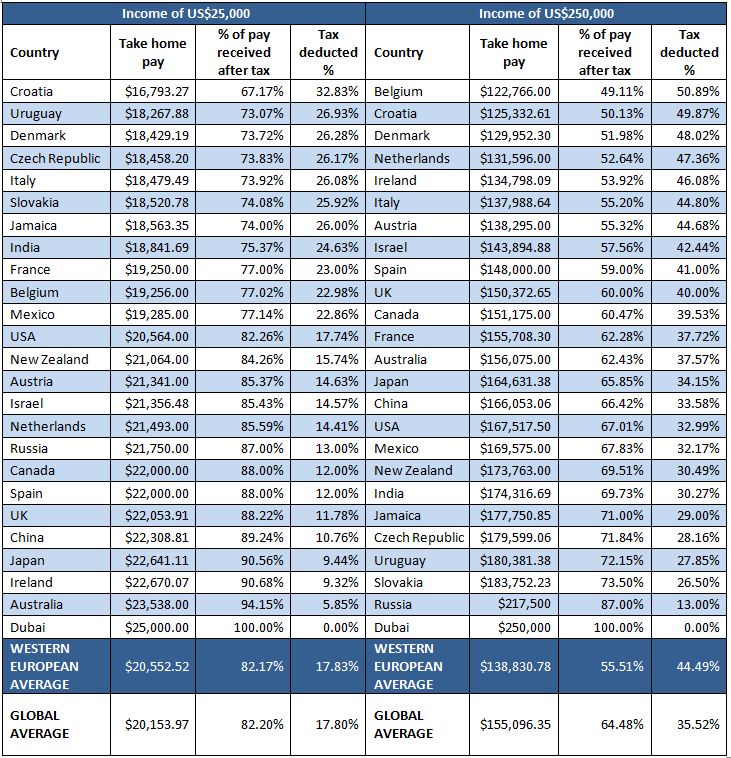

At a slightly more modest income of US$250,000 the gap is even wider, with taxpayers in Western Europe allowed to take home only 56% of earnings, compared to 65% in other major developed economies.

A middle-income taxpayer earning US$50,000 in a Western European economy would receive close to the global average net income at that salary – US$35,935 in Western Europe compared to US$37,695 globally. However, the 28% they would pay in tax compares unfavourably with the 23% they would pay in the USA.

UHY adds that Eastern European and emerging economies continue to offer the most generous tax regimes to higher earners. In Dubai and Russia flat rate, or no, taxation means that all taxpayers take home 100% and 87% of their pay respectively, while taxpayers earning US$1.5million in Slovakia, the Czech Republic, Jamaica all keep more than 70% of pay.

UHY observes that some Eastern European economies may be gradually eroding this advantage as they increase the tax burden on top earners. For instance those earning US$1.5m in the Czech Republic have seen the amount of tax they pay increase by US$183,409 since 2012, thanks to a ‘solidarity surcharge’, against a global average tax rise for this group of US$6,531.

Western countries move to reduce taxes for top earners

UHY notes that while top earning Western European taxpayers are still losing by comparison with peers globally, several countries (Italy and the UK) have dramatically reduced or withdrawn top rate tax bands imposed following the financial crisis.

For example, in 2014, a taxpayer earning US$1.5m in the UK was US$63,601 better off than two years ago, following the abolition of the 50p tax rate last year.

The USA also substantially reduced the amount of tax it took from top earners, lowering the tax take from an income of US$1.5 million to 42.57% of earnings from 43.28% - saving high earners US$10,656.

In contrast, a taxpayer earning US$1.5m in France would be US$44,646 worse off after tax than in 2012, after President Hollande introduced a new tax bracket of 45% for people earning more than €150,000. However, President Hollande’s plans to impose a 75% supertax on incomes of over EUR1 million were met with resistance and were instead replaced with a temporary additional tax to be paid by employers on salaries above EUR 1 million.

Ladislav Hornan, Chairman of UHY, comments: “The message that high taxes on top earners are uncompetitive has made some impact in Western Europe, and governments have taken steps to reduce the rates on top earners.”

“However, the gap between how heavily you are taxed in Western Europe compared to other developed economies remains striking, especially at the US$250,000 level. That’s a typical income for a successful engineer, marketeer or head of IT.”

“As the global economy improves and new job opportunities open up, Western European governments need to be aware of the risk of a brain drain of skilled professionals.”

UHY studied tax data in 25 countries across its international network. The study captured the ‘take home pay’ for low, middle and high income workers, taking into account personal taxes and social security contributions. High earners were defined as workers earning US$1,500,000 per annum. The calculations are based on a single, unmarried taxpayer with no children.

*Western European economies in the study are; France, UK, Italy, Austria, Spain, Ireland, the Netherlands, Denmark and Belgium.

*Minus figures indicate a decrease in tax home pay.

**Denotes countries where the change in tax home pay in USD is a result of exchange rate fluctuations and not due to a change in tax.