European countries, on average, have a tax burden of 43.3% of Gross Domestic Product (GDP), nearly twice the average rate for the major emerging BRIC economies (21.8%), shows research by UHY, the international accounting and consultancy network.

The European average of 43.3% is also over 50 percent higher than the global average (28.2%) in the study.

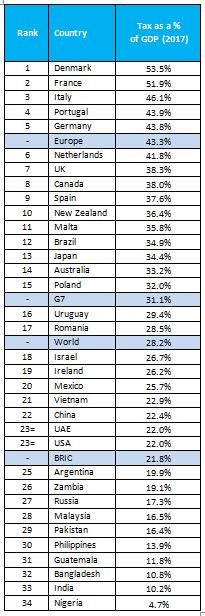

UHY studied 34 countries around the world, calculating what percentage of that country’s GDP is taken by the Government in tax (see chart below).

Denmark came top of the study with the Government’s tax take representing 53.5% of total GDP, a position it also occupied in a previous UHY study on the same topic conducted in 2015, with a rate of 48.6%.

The G7 average of 31.1% is closer to the global average with the USA (22%) and Japan (34.4%) seeing lower tax takes than their European competitors. The US percentage could fall further in the coming years as some commentators claim that the US President Donald Trump’s recent tax plan could see US Government tax revenues fall by as much as USD$2 trillion.

Emerging economies in general have seen much lower levels of Government tax ‘take’, including many in the ASEAN (Association of Southeast Asian Nations) trading bloc such as Malaysia (16.5%) and the Philippines (13.9%).

Bernard Fay, Chairman of UHY, comments: “Developed economies need to investigate ways of lowering the tax burden for businesses or they may find increasing competition from more dynamic emerging countries.”

“Lower personal and business taxes can help economies spur growth and create incentives, particularly for investors and larger, more globally-focused businesses.”

“Emerging economies often look for special tax measures to encourage growth in particular sectors or segments of the economy. Lower tax rates can make economies more dynamic and can help encourage inward investment.”

“For more developed economies it can often be harder to balance an aging population with trying to reduce the tax rate, but Governments will need to try and find a way.”

For example, in order to increase investment into generating alternative energy power, Pakistan’s Government offers a first-year allowance of 90% of the cost of the plant and other machinery. In some cases, even profits and gains from the generation can be exempt from tax.

Rick David of UHY member firm UHY Advisors in the US says: “The US President’s recent tax cuts – of up to USD$1.3 trillion – is likely to encourage further economic growth. Ambition remains strong to provide incentives and create an environment for businesses and individuals to thrive in by reducing the tax burden. These latest cuts could come as a bit of a wakeup call to other rival, developed economies.”

Levels of tax take by national Governments are of growing interest, particularly for the EU at the moment with Brexit on the horizon, to secure Government funding in the short term and encourage growth in the long-term.

The Republic of Ireland is the only Eurozone country studied where Government tax take is below the global average.

Recently, the European Commission suggested that EU countries may have to consider changing tax policies to help fill the €15 billion annual budget hole left by the UK’s Brexit. These could include proposals such as using a portion of corporate tax receipts from national treasuries for the EU’s common funds and programmes.

However, many European countries, including Germany and Portugal, with higher than average tax take are looking at ways to reduce the burden. For example, the German government (43.8% of GDP) has the goal of relieving the tax burden on SMEs to incentivise innovation, including:

- Implementing tax support in research and development for companies with fewer than 1,000 employees

- Establishing a ‘high-tech founder fund’ with a target volume of €300 million

- Starting a new digitisation campaign for medium-sized companies

Carlos Costa of UHY member firm UHY & Associados SROC Lds in Portugal comments: “While the Portuguese government could do more to incentivise foreign-based businesses setting up offices in Portugal, the government has already begun to address the issue of high taxation."

"Portugal has many programmes designed to help reduce the tax burden and has signed more than 60 treaties to eliminate ‘double taxation’, including with Malta and Hong Kong.”

“Additionally, the Portuguese government has created tax incentives and benefits for companies investing in R&D (SIFIDE), for investment promotion in several business sectors (RFAI), and also for net young employment creation, among others."

WESTERN EUROPEAN ECONOMIES SEE, ON AVERAGE, A TAX BURDEN NEARLY DOUBLE THE RATE OF MAJOR EMERGING MARKETS

Notes for Editors

UHY press contact: Dominique Maeremans on +44 20 7767 2621

Email: d.maeremans@uhy.com - www.uhy.com

Nick Mattison or Peter Kurilecz

Mattison Public Relations

+44 20 7645 3636, +44 7860 657 540 or email peter.kurilecz@mattison.co.uk

About UHY

Established in 1986 and based in London, UK, UHY is a leading network of independent audit, accounting, tax and consulting firms with offices in over 320 major business centres across more than 95 countries.

Our staff members, over 8,100 strong, are proud to be part of the 16th largest international accounting and consultancy network. Each member of UHY is a legally separate and independent firm. For further information on UHY please go to www.uhy.com.

UHY is a member of the Forum of Firms, an association of international networks of accounting firms. For additional information on the Forum of Firms, visit www.forumoffirms.org