60% tax on petrol gives Britain, France and Germany some of the highest pump prices worldwide. Some emerging economies benefit from 0% fuel tax, or even subsidies.

The major European economies of the UK, Germany and France have the highest cost of fuel among the major world economies, according to a new study by UHY, the international accountancy network.

UHY explains that the UK, France and Germany all levy taxes of at least 60%* on petrol, considerably more than other major developed economies such as the United States, Canada and Australia.

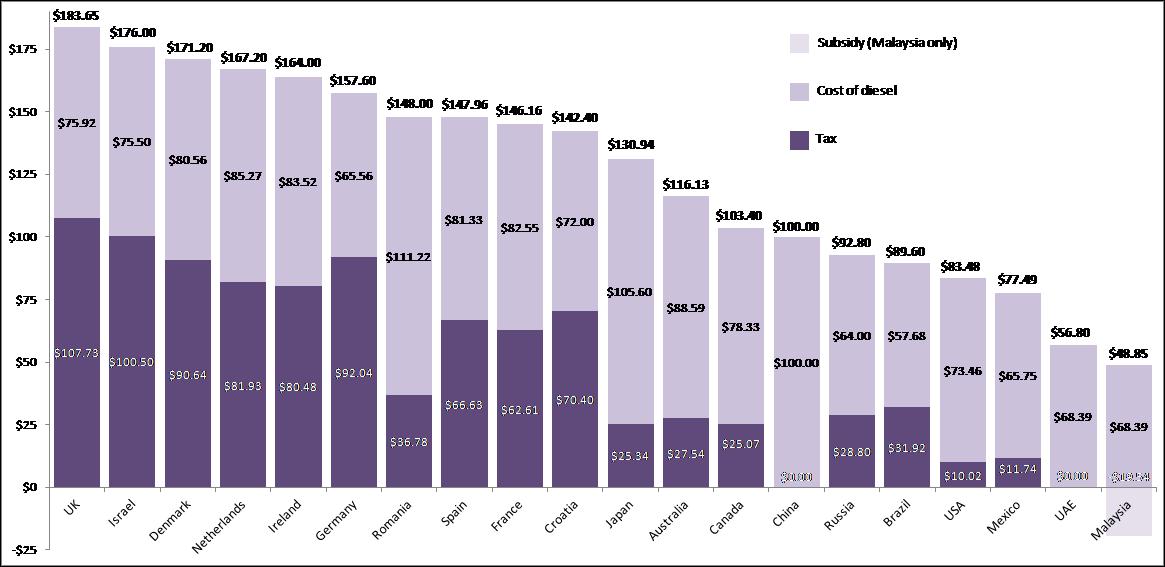

Taxes amount to 59% of the cost of diesel in the UK, which is the highest in any major economy. France levies 43% tax on diesel, while Germany levies 58%.

This means that the cost of filling the tank** of a Ford Transit van with diesel in the UK amounts to $184. In comparison, French and German consumers pay $146 and $158 respectively.

UHY says that as diesel is used in the majority of commercial vehicles, this heavy burden is borne primarily by businesses.**

In contrast, both of the world’s largest economies, the United States and China, have extremely low fuel taxes. The United States levies just 13% on petrol and 12% on diesel, whereas China levies no taxes at all on these fuels.

UHY says that while governments say that petrol taxes are important in cutting greenhouse gas emissions, the transport lobby and SMEs argue that they add costs for all businesses.

Even for Liquefied Petroleum Gas, a more environmentally-friendly alternative to petrol or diesel, the UK still levies taxes of 60%, the highest in the developed world by some distance. France levies an 11% tax on LPG, while Germany levies 33%.

UHY adds that this study is a reminder that all advanced economies must makes continued efforts to maintain tight control on the levels of business taxation, especially as the recovery from recession starts to gather pace.

Ladislav Hornan, chairman of UHY, says: “Taxes on fuel are an area in which the major European economies place a bigger burden on businesses than any other countries, which could act as a brake on the speed of recovery from the recession.”

“While the British Government’s cuts to corporation tax are certainly popular with businesses, the 60% tax on petrol is still a considerable burden for them to carry, particularly as reclaiming the VAT element can be complex, especially for smaller businesses.”

“The United States is already quite a distance ahead of the UK, France and Germany in its economic recovery, and its lower levels of taxation in areas like fuel may well be helping to stimulate growth.”

“It’s important for Governments in major economies like the UK, France and Germany to balance the revenues they receive from taxing fuel with the potential for economic stimulation that a cut in fuel taxes would provide.”

“Reduced taxes on diesel would be particularly advantageous for fast-growing small and medium businesses that run fleets of commercial vehicles, especially in sectors like distribution and retail. These businesses can be key drivers of economic recovery.”

US federal fuel tax – unchanged for 20 years, but under pressure

UHY says that the United States levies a federal fuel tax of 18.4 and 24.4 cents per gallon on gasoline and diesel, which alongside state taxes on fuel consumption contribute to an average US fuel tax of 13% on gasoline and 12% on diesel.

This federal fuel tax has not risen in 20 years. In late 2013, a proposal was introduced in Congress to increase that fuel tax to 33.4 cents per gallon on gasoline and 42.8 cents per gallon on diesel.

Comments Scott Miller, Partner and National Petroleum Practice Leader of UHY Advisors in the US: “Increasing the federal fuel tax is a political challenge that few US politicians would be enthusiastic about. While some argue that a fuel tax increase is needed to fund transportation infrastructure, others maintain any tax increase would be a drag on the economy. At the state level, with decreasing gas consumption and increasing infrastructure costs, many states are considering gas tax increases or other tax changes to make up for the lost gas tax revenue.”

Emerging economies have lighter fuel tax burden – and some even offer subsidies

UHY says that most emerging economies have considerably lower levels of taxation on fuel than developed economies.

Some countries such as China levy no tax at all on petrol or diesel, while Malaysia offers subsidies of 30% on petrol and 40% on diesel.

UHY says that fuel taxation has been a controversial subject in China in recent times, with the farming lobby pointing out the problems that potential fuel price increases may cause for the country’s agricultural industry.

UHY adds that the Malaysian fuel subsidies cost the Malaysian government an estimated $14 billion per year. The subsidies have also led to issues with the smuggling of fuel into neighbouring China and Indonesia, which have a much higher cost of fuel.

Comments Alvin Tee, Senior Partner of UHY in Malaysia: “Emerging market economies are much more focused on growth, and providing assistance to businesses through lower taxation and subsidies where necessary.”

“The Malaysian economy is one that levies low taxes on consumption in general, and focuses on direct taxation of businesses, such as through corporation tax, as the key generator of revenue.”

UHY says that the United Arab Emirates also falls into this group. The UAE levies no tax on petrol or diesel at point of consumption, though levies a special corporation tax on foreign oil companies operating in the country, which at an average of 55%, is higher than most countries’ corporation tax rates.

Says David Burns, Partner UHY Saxena, UHY member in the UAE: “The United Arab Emirates has the advantage of being one of the most significant oil-producing countries in the world, which makes levying a tax on fuel unnecessary. This is certainly a major benefit for both consumers and non-oil businesses as the country seeks to develop a more diverse economy.”

Filling the tank of a Ford Transit with diesel – proportion of cost made up of fuel cost and tax

Filling the tank of a Ford Transit with petrol – proportion of cost made up of fuel cost and tax

Filling the tank of a Ford Transit with LPG – proportion of cost made up of fuel cost and tax

*Tax rates include VAT, some or all of which may be reclaimed by businesses in some countries, including EU member states.

** Tank size: 80 litres for petrol and diesel, 72 litres for LPG.