Brazil and India hit consumers with the highest levels of consumption and sales taxes in the world, according to new research by UHY, the international accounting and consultancy network.

UHY adds that behind India and Brazil, European countries impose the heaviest sales tax burden, which threatens to undermine recoveries in consumer spending by putting pressure on disposable incomes.

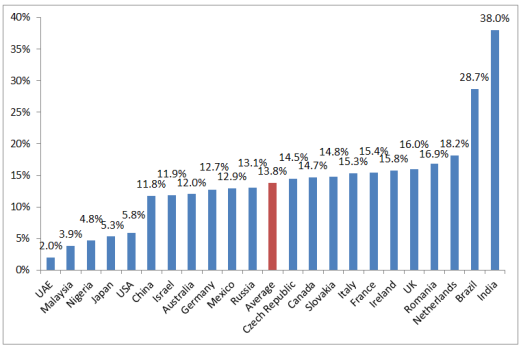

UHY tax professionals studied data from 22 countries* across its international network, including all members of the G8 and the developing BRIC economies. UHY calculated the percentage of the total price of a representative basket of goods and services that was made up of taxes and duties.

The Brazilian and Indian governments take 28.7% and 38% respectively of the total price of the basket of goods and services through taxes. On average, European governments are responsible for 15.5% of the price of UHY’s basket of goods and services.

This compares to an average of 13.8% for all countries, an average of 8.2% in the Asia-Pacific countries, 12.3% in G8 countries.

Ladislav Hornan, chairman of UHY, says: “Brazil and India, like many developing economies, rely far more on sales taxes than income taxes compared to their more economically developed counterparts. Lower income taxes can have a positive effect on productivity, as it encourages individuals to work harder and entrepreneurs to generate more wealth.

“However, questions remain as to whether these high consumption taxes have hindered the growth of vibrant consumer element of those economies.”

UK and Europe struggle with high direct and indirect taxes

UHY says that while some developing economies balance high sales taxes with low income taxes, the UK and European governments levy some of the highest sales and income taxes in the world.

Ladislav Hornan says: “European economies have ‘zig-zagged’ over the past few years, limping into growth and slumping back into decline. Struggling with huge budget deficits, European governments have raised income and sales taxes. This has severely discouraged the consumer spending that could support a stronger recovery.

“Comparing the sales taxes in the US and Europe, it is clear where consumers have a better deal.”

The UK, the Netherlands, and France have all increased their sales taxes recently – the UK raised VAT from 15% to 20% with two changes in the space of just two years. France plans further rises in 2013.

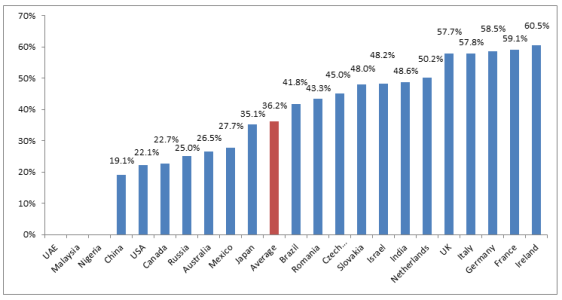

UHY adds that taxes on ‘necessity’ purchases in Europe are exceptionally high. There are six countries in the study where over 50% of the price of a litre of petrol is made up of taxes: Ireland (60.5%); France (59.1%); Germany (58.5%); Italy (57.8%); the UK (58%); and the Netherlands (50.2%).

Ladislav Hornan says: “European countries’ high indirect taxes have a particularly heavy impact on low earners. Necessary costs, like petrol or household energy bills, form a significant proportion of small, fixed incomes. The benefits of progressive income taxes are lost with high sales taxes.

Six of the ten countries with the highest taxes on household energy bills were European countries, with an average of 19% of energy bills in these countries being made up of tax.

UHY warns that excessive levels of indirect taxes can penalise businesses that may be struggling to compete in an increasingly international marketplace.

Ladislav Hornan says: “High sales and consumption taxes put a lot of pressure on businesses’ bottom lines. In order to compete on price and to keep customers shopping, some businesses may opt to absorb sales taxes, especially if they are raised significantly or repeatedly.

“With the rising dominance of e-commerce, especially in retail, many businesses will find their competitors are now based overseas in countries with lower sales taxes. This makes absorbing domestic tax rises all the more important, and has been a notable problem in the EU.”

UHY adds that the study shows that some countries’ tax systems have struggled to catch up with the rise of e-commerce.

In several countries, including India, Malaysia, Israel, the US, and Italy, sales taxes were levied on physical CDs but not on the mp3 versions of the same albums.

Ladislav Hornan adds: “New technologies and globalisation have caused plenty of problems for unwieldy and complex tax systems. Tax systems can be very slow to react to the rise of new ways of doing business, and can leave traditional businesses – like physical stores – at a disadvantage.”

The Malaysian government levied one of the lowest levels of indirect taxes in the study and was only responsible for 3.9% of the total cost of the basket.

Seri Sofia Irmawati, head of tax at UHY Tax Advisory (Malaysia) and member of UHY, says: “Malaysia operates a range of consumption taxes, but these are only charged on relatively few goods. They are either used as ‘sin’ taxes on products such as alcohol or cigarettes, or import taxes on expensive goods.

“Malaysia’s low level of indirect taxes is a boost for the consumer economy. Low consumption taxes provide businesses with plenty of flexibility on price and help keep goods affordable for Malaysian consumers.”

At the other end of the scale, Brazil’s indirect taxes were some of the highest in the study. Brazil’s government was responsible for 28.7% of the cost of the basket.

Diego Moreira, executive director of UHY Moreira-Auditores in Brazil, and member of UHY, adds: “Direct taxes on individuals in Brazil are very low, but this means the tax burden falls heavily on businesses and consumption instead.”

“High indirect taxes can discourage spending and put pressure on business’ margins. Indirect taxes in Brazil are also highly complicated, which can make it hard for consumers to understand how the tax system operates. This complexity will add to business compliance costs too as they have to account for the different taxes.”

Table 1 - Basket of items

Table 2 – Percentage of the total price of UHY’s basket of goods and services that is tax, by country (including excise duties and consumption taxes)*

Table 3 –Percentage of the total price of a litre of petrol that is tax, by country **

*Taxes may vary between states in some countries. For the US, China, Australia, and Canada, taxes are specific to Michigan, Beijing, Perth, and Toronto respectively

**Nigeria, UAE, Malaysia do not levy taxes on fuel

For additional information about this aticle please download the PDF below.