Each year the World Bank pinpoints statistically where in the world it is easiest to do business. The bank’s analysis is used sometimes as a starting point to determine where cross-border development of a product or service is most appropriate. Or, it is sometimes used as evidence to support a strong hunch that business success is up for grabs, barring a few barriers.

The World Bank Doing Business Guide 2013 – the 10th edition – benchmarks 185 economies against 10 topic areas (such as starting a business, getting credit, paying taxes and enforcing contracts). Contributors include accountants, lawyers, freight forwarders and government officials. There can be little argument therefore that the report is a near-global, comprehensive measurement of a regulatory quality, and a worthy piece of armoury when deciding where to invest.

The survey is particularly pertinent in today’s global economy because tighter budgets make the need to choose the right international opportunity, and get it right first time, even more imperative: it’s also pertinent for investors to have the local knowledge and forethought so they can work fast as new opportunities are about to develop – and, in some cases, pull out just as quickly as they are about to evaporate.

The 2013 report, published mid-October 2012, confirms what investors would expect – that doing business remains easiest in high-income, developed economies. But that’s where most competition is also found – and, anyway, investors are often more adventurous and creative, looking for places to innovate, to take sensible risks, to meet new challenges and to benefit from markets about to evolve.

Key measures in the survey

‘Ease’ of doing business is measured in the World Bank survey by the number of regulations applied to small to medium-sized companies (SMEs) and the ease of compliance across the 10 topic areas. Significantly, given the potential of new markets in the developing world, ‘getting electricity’ is one of the key measures.

Top countries for ease of doing business

In the overall league of the top countries for ease of doing business, the more risk-adverse investor may be drawn to locations that are ‘safer bets’, such as Singapore at No 1 (Singapore has topped the global ranking for the past seven years) or New Zealand at No 3.

But places like Georgia (impressively at No 9) – and other economies which have most improved their ease of doing business over the past year – may give an indicator of increasingly favourable regulatory terms for future investment.

‘Most improved’ economies

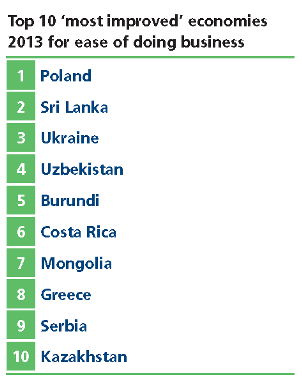

Poland tops the table of ‘most improved’ economies. “Poland improved the most in ease of doing business through four reforms – easier to register property, pay taxes, enforce contracts, and resolve insolvency by updating documentation requirements for bankruptcy filings,” says Wiesław Les,niewski, of UHY’s member firm in Poland, Biuro Audytorskie Sadren Sp. z o.o. “Poland also introduced a new civil procedure code that, along with an increase in the number of judges, reduced the time required to enforce commercial contract.”

No 2 in the ‘most improved’ rankings is Sri Lanka – the first time in seven years of the survey that a South-Asian economy has featured among the ‘best improvers’. Significantly, too, Greece – somewhere investors may not currently have top of their list – has jumped these rankings significantly to eighth place. Driven by its economic crisis,

Greece has implemented regulatory reforms to ease doing business “at a greater pace in the past year than in any of the previous six”, says the World Bank.

“Despite the present negative media publicity we are receiving, Greece has taken radical legislation, regulation and organisational steps to improve and facilitate investors interested in investing in Greece, “ says Stavros Nikiforakis, UHY Axon Certified Auditors, based in Athens. “With ‘fast track’ law, the Bilateral Committee of Strategic Investments (BCSI) has been formed and through it the procedures have been simplified and centralised to ‘one shop’. This allows investors to concentrate on operational issues whilst the issues relating to authorisations and approvals are executed by civil servants of the appropriate government department.

“The BCSI is responsible for considering the eligibility of the proposed strategic investments based on the criteria of:

- Feasibility of the project

- The investors’ solvency

- Transfer of knowledge and technology

- Forecast increase in employment

- Peripheral or local development of the country

- Subsidies for the enterprise

- Competitiveness in the national economy

- Protection of the environment

- Saving of energy.

Ukraine (at No 3 in these ‘most improved’ rankings), Uzbekistan (No 4) and Kazakhstan (No 10) show how the Eastern European region is beginning to provide a more favourable environment for investment.

Sarvarkhon Karimov, UHY Tashkent LLC, Uzbekistan, says that his country has made starting a business easier by introducing an online facility for name reservation and eliminating the fee to open a bank account for small businesses.

Uzbekistan has improved access to credit information by guaranteeing borrowers’rights to inspect their personal data. And it has reduced the time to export by introducing a single window for customs clearance and reduced the number of documents needed for each import transaction.

Uzbekistan has also strengthened its insolvency process by introducing new time limits for insolvency proceedings and new time limits and procedures for a second auction, and by making it possible for businesses to continue operating throughout liquidation proceedings.

Costa Rica is the only economy in Latin America or the Caribbean in the top 10 ‘improvers’. Costa Rica introduced a risk-based approach for granting approvals for business start-ups and established online approval and tax payment processes. But Colombia, while outside the top 10 ‘improvers’, gets special mention for implementing 25 regulatory reforms over the past eight years.

“Improving business regulation is a challenging task,” says the World Bank, “and doing it consistently over time even more so.” Yet, it says, some economies have achieved considerable success since 2005 and a few stand out as exceptional within their regions – Georgia, Rwanda, Colombia, China and Poland.

As an example, the survey highlights Georgia’s 35 reforms, which have followed “a relatively balanced regulatory reform path”, since 2005 – such as its moves to make trading across borders easier by introducing customs clearance zones in cities such as Tbilisi and Poti. “These one-stop-shops for trade clearance processes are open all day, every day, allowing traders to submit customs documents and complete other formalities in a single place,” says the survey.

Most challenging locations

UHY member firms operate in more than 80 countries globally – across almost all the World Bank listings – and offer support to investors through local knowledge and an in-country presence, whatever local regulations are in force.

But perhaps that level of support is particularly valuable in the more difficult jurisdictions for starting a business, as shown in the World Bank survey – such as in Angola (ranked 172) and Venezuela, which ranks 180 in the ease of doing business stakes out of the 185 jurisdictions surveyed.

“Angola is in a situation of political and economic stability, and is one of the fastest growing economies in the world, essentially due to its natural resources,” says Armando Parades, UHY A Paredes e Associados-Angola Auditores e Consultores, based in Luanda. “The Angolan authorities have been trying to improve the country’s business environment with significant recent changes to private investment laws and a comprehensive tax reform.

“Although bureaucracy remains high, infrastructures are scarce and the justice system is inefficient, continuing improvements have been happening throughout the economy as a whole and the outlook for the future is very positive. Although obstacles are still high, investing in Angola is considered very rewarding, because economic growth has created opportunities in most economic activities. If the country continues the trend towards the reduction of business barriers its attractiveness as an investments destination will grow even further.”

By comparison, the Venezuelan president’s victory last October opened the way for further radicalisation of his agenda that economists predict will lead to further tough economic challenges: Venezuela is expected to remain one of the least-friendly places to do business over the next few years. In fact, Venezuela is referred to in the World Bank survey in the same context as Zimbabwe – “a deteriorating business environment where measures add to the complexity and cost of doing business or undermine property rights and investor protection”.

All of which makes the work of UHY firm, UHY Servicios Legales & Tributarios, S.C., based in Caracas, still more challenging – and more valuable to investors looking to the probable medium-term opportunities in that country when a new political regime may be in power.

Sub-Saharan Africa

UHY member firms are also building a still more extensive presence in Africa, both in the north and in sub-Saharan Africa, which gets a special mention in the World Bank survey for its record number of reforms – a region where less than 10 years ago little attention was being paid to the regulatory environment.

Among the 50 global economies with the biggest improvements since 2005, the largest share – one-third of them – are in sub-Saharan Africa. Burundi is ranked No 5 in the ‘best improvers’ table (for reforms to starting a business, construction permits, registering property and trading across borders) but top billing in the World Bank survey goes to Rwanda (for a whole raft of entrepreneurship reforms), which has been the top improver in sub-Saharan Africa since 2005.

BRIC countries

Two of the BRIC countries (Brazil, Russia, India, China) rank among the top 50 improvers in the survey: China and India. They were further up the scale in earlier years of the survey, but in the overall global table for ease of doing business they currently have quite low rankings: for example, China is at No 91, Brazil at No 130 and India at No 132 – suggesting perhaps that they have not sustained regulatory reforms that would have placed them consistently among the top-runners.

BRIC countries are not prominently featured in the 2013 World Bank survey, but previous World Bank survey reports have painted a picture of why the BRICs appear not to fare so well in the survey.

Enforcing contracts has been perceived by entrepreneurs as a problem in China – although the mass market opportunities for consumables make investors try and try again. The problem with India is that it has a tendency towards bureaucracy and red tape, and there is lack of political consensus on important issues such as business liberalisation. Reasons to invest, however, are the stable democratic environment, the huge market and the availability of skilled manpower – attractions particularly for investors in ‘big-number’ sectors such as technology, telecoms and airports.

Russia stands out as an environment with doing business issues over ‘rule of law’ and excessive government control. “Foreign investors are wary of lack of reform to eliminate risks for their investments,” the World Bank has said previously. But reasons to invest in Russia include planned privatisation of government shares in oil, telecoms and transport, and huge undeveloped territory rich in natural resources.

Some parts of Brazil make good investment locations and the country has a thriving consumer market at all socio-economic levels. The oil and gas sector has huge potential. But obtrusive labour laws are a problem for investors, the World Bank has said, and obtaining certain operating licences can take too long.

Diego Moreira, UHY Moreira-Auditores, Brazil, says his firm can help facilitate these bureaucratic processes. “For example, we can help alleviate compliance with obtrusive labour laws by providing consultancy on human resource (HR) practices as well as providing outsourced HR management,” he says.

“On obtaining operating licences, UHY Moreira can reduce the timeframe required to obtain several types of licence (export/import, sanitary, etc) as well as perform the bureaucratic processes for each type of licence.

“For investors interested in the oil and gas sector, UHY Moreira can assist foreign firms register in the all-important Petrobras suppliers registry. (Petrobras is the state-owned oil and gas company.) Such registration is key not only for obtaining contracts with Petrobras but also for being considered as a ‘player’ in the local oil and gas market.

“Furthermore, through our attest services (audits, due diligence, limited-scope reviews) we can significantly reduce the risk that foreign investors face when acquiring companies in Brazil or when establishing joint-ventures or other types of corporate associations with Brazilian firms. Such risk mitigation factors are of outmost importance due to widespread labour litigation and tax-related legal contingencies.”

The other country commonly aligned with the BRIC nations, South Africa, has been credited by the World Bank with encouraging investors; its natural resources are in abundant supply; the economic structure is ‘first-world’; the country is already doing strong business compared with other BRIC nations; and the jurisdiction offers a credible connector to one billion consumers on the African continent. Difficulties highlighted are comparatively minor, such as the process for registering for VAT because of significant amounts of fraud (vendors claim and are paid VAT refunds then disappear).

Other investment factors

Measuring regulatory ‘red tape’ in the lifecycle of an SME is all to the good, but the World Bank stops short of measuring economic stability, corruption or other relevant factors affecting markets, such as the consumer’s struggle out of poverty. Investors need to look elsewhere.

For corruption indicators, another report, the Transparency International Corruption Perceptions Index, is a useful guide. In it, among the BRIC countries, Russia tops the league (perceived to be the most corrupt), with India some way behind in second – both outstripping Brazil and China, with South Africa perceived as the least corrupt location in which to do business. In countries overall where UHY member firms operate, New Zealand comes top as the perceived least corrupt nation, while Venezuela comes bottom.

Another index could also be taken into account when deciding where best to invest: The Legatum Prosperity Index measures countries’ prosperity, based on both quality of life and material wealth. This measure is pertinent because its research shows that entrepreneurship – encouraging new ideas and opportunity – correlates more closely to a nation’s overall prosperity than any other factor. Top of that league is Norway, followed by Denmark, Australia, New Zealand and Sweden. Among the BRICs, China has improved in the prosperity rankings while other countries have changed in their ranking relatively little.

Key survey indicators

One key finding of the World Bank survey is that European economies in fiscal distress are making efforts to improve their business climate, and this is beginning to be reflected in the indicators being tracked. Part of the solution to high debt, says the World Bank, is the recovery of economic growth, and there is broad recognition that creating a friendlier environment for entrepreneurs is central to this goal.

Policy-makers worldwide have given more attention to one area of business regulation tracked by the World Bank survey over the past year than any other – starting a business. The average time to start a business worldwide has been reduced significantly, from 50 days to 30 days, and the average cost from 89% of income per capita to just 31%.

But perhaps the “most exciting finding”, says the World Bank, is the “steady march from 2003 to 2012 towards better business regulation across the wide range of economies included”. With a handful of exceptions, every economy covered by the survey has narrowed the gap in business regulatory practice with the top global performance measured by the indicators. “This is a welcome race to the top,” says the bank.

But does all this matter? Does regulatory quality affect the mindset of investors? Yes, it does, says the World Bank. In a separate study, the World Bank estimates that, on average throughout all global economies surveyed, a difference of 1% in regulatory quality as measured in the survey is associated with a difference in annual foreign direct investment inflows of USD 250-500 million.

Matched with specialist advice from experts on the ground, and trusted local partners, the World Bank’s guide and other indexes may confirm an investor’s insight into a potential economic advantage and point to further new opportunities; they may question an investor’s ambition (such as to dive into a huge, new-growth market in a jurisdiction that’s politically unstable); or, at the very least, they may enable would-be investors to assess more accurately the risks involved when going international.

“Significantly, given the potential of new markets in the developing world, ‘getting electricity’ is one of the key measures.”

UHY member firms help mid-size companies to internationalise

For example, UHY’s member firm in Spain, UHY Fay & Co, has been working with Hidral S.A. The company manufactures passenger and goods lifts and platforms which are sold exclusively to other lift manufacturers, installers and maintenance companies to complement their own product range.

With 165 employees at two manufacturing plants in Seville, Spain, Hidral has a turnover of Euro 18 million (USD 25.8 million). The company also has a subsidiary at Iandaiatuba, São Paulo, Brazil (Hidral Elevadores DO), and in Moscow, Russia (Hidral RU). Its distributors are in France, Lebanon and Russia. Over the last decade the Russian market has been one of Hidral’s main export successes, as well as the region producing its biggest growth.

Hidral has an outstanding position in its market sector: its products are represented in more than 45 countries and its export sales represent 40% of total turnover.

UHY Fay & Co worked with UHY’s member firm in Brazil, UHY Moreira - Auditores, to establish the company’s manufacturing plant in Brazil, Hidral’s first such venture internationally, and UHY Fay & Co’s legal team worked with UHY Yans-Audit LLC, based in Moscow, to establish the company’s subsidiary in Russia. UHY Yans-Audit is now managing accounting, tax compliance and contracting services for the Russian subsidiary.

Hidral previously used the services of a sizeable and well-known Spanish law firm, together with its partner company in Brazil, which was one of Brazil’s top law firms. The experience was not satisfactory and Hidral transferred its business to UHY Fay & Co “to work with a firm that allows the development of a closer relationship with communication at the top, as it allows a swift and efficient decision-making process”, says Javier Martínez, Hidral’s marketing & sales director. “We also needed a firm with a clear focus on developing international business.

“With UHY Fay & Co, we value the transparency in the valuation of its services, the fast and efficient development of the engagements, and its proactive follow-up of the different projects,” says Javier Martínez. “We also value very highly the fluent communication between the different UHY offices involved in the engagement.”

Hidral S.A.

www.hidral.com

Details of all UHY member firms, their locations and their local financial and business advisory services for investors going international are available on the UHY website: www.uhy.com. Doing Business Guides for all UHY locations can be found under the publications section of the UHY website.