- Relatively low import tariffs help keep goods costs down

- Free Trade Agreements an increasingly critical policy area

Consumers in the US, UK and other developed economies benefit from customs duty rates around half the global average, saving them significant amounts of money according to a new study by UHY, the international accounting and consultancy network.

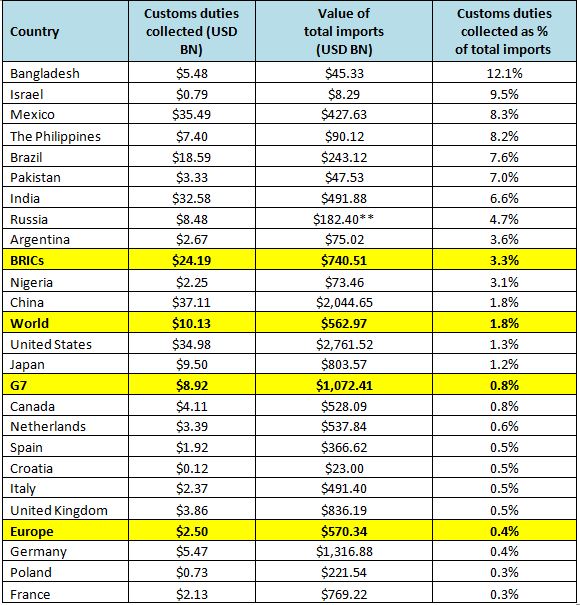

UHY found that customs duties in the G7 are, on average, just 0.8% of the total value of imported goods. The global average is 1.8% of the total value of imported goods*.

This means that consumers in the G7 typically pay comparatively lower prices for goods than consumers in many other parts of the world – including many emerging economies - where costs are pushed up by higher import taxes.

UHY studied customs duties levied by 22 economies around the world as a percentage of the total value of their imports, as a simple indicator of the impact of a country’s trade barriers.

In the US, where protectionism has been rising up the political agenda, raising the possibility that higher import duties may be levied, customs duties are currently worth just 1.3% of the value of imported goods. This compares to 1.8% in China.

In the UK, where Brexit is also creating uncertainty over the future of UK trade deals, customs duties are currently even lower, worth just 0.5% of the value of imports.

European countries generally impose comparatively low rates - the European average is 0.4% - so British consumers could be at a significant disadvantage if the UK fails to keep duties at a similar level on leaving the EU.

UHY points out that many regional trade blocs – and in particular the EU - help to keep import tariffs low. Given the size of UK/European trade, this highlights the importance of securing low or no customs duties post-Brexit for both the UK and the EU.

Other multi-lateral trade agreements are also under pressure. For example, the US has signalled it wants to renegotiate the North American Free Trade Agreement (NAFTA) and has abandoned the Trans Pacific Partnership (TPP), throwing the future of both into doubt.

Bernard Fay, Chairman of UHY, comments: “Customs duties can be a major burden on consumers and significantly distort an economy.”

“Globalisation and protectionism are powerful forces at play. While talk of securing national interests may be gaining traction, the question of how citizens will respond to higher trade tariffs is yet to be tested.”

“Such policies could end up having an adverse impact on the industries governments are trying to protect, potentially undermining efforts to stimulate competitiveness or drive innovation.”

Eric Hananel, Tax Principal at UHY’s US member firm UHY Advisors, says: “Motivations to adopt a protectionist stance to safeguard jobs and nurture home-grown industry can be very compelling. However, there is often a price to pay through higher costs of goods. Lower income consumers tend to be worst affected.”

“The US has historically been a strong champion of free trade deals, but there’s now real uncertainty over America’s future participation. Given that we are talking about the world’s biggest economy, this is a highly significant global issue.”

Bangladesh has the highest customs duties as a proportion of total imports of any country in the study at 12.1%.

Of the major emerging economies, Brazil also imposes relatively high rates, with duties worth 7.6% of the total value of its imports. The Brazilian government is currently seeking to protect specific products and industries from foreign imports by increasing customs duties, for example in the cosmetics sector.

FREE TRADE AGREEMENTS, AN INCREASINGLY CRITICAL POLICY AREA

Bernard Fay adds: “Free Trade Agreements are becoming an increasing critical – as well as contentious – policy area.”

“As protectionist moves on the part of some governments are putting some Free Trade Agreements under review, other countries are embracing them with as much enthusiasm as ever, if not more.”

For example, earlier this year, Canada entered into formal free trade negotiations with Mercosur, the South American trading bloc and also launched a consultation period on a possible deal with China. Its plans for a free trade deal with the EU have recently been approved by the European Parliament.

Koko Yamamoto of UHY’s Canadian member firm McGovern Hurley LLP says: “Canada has a wide array of free trade deals in place and is actively pursuing several more with potential partners around the world. These initiatives, along with tariff-reduction measures introduced in the recent Budget, should strengthen the competitiveness of Canadian manufacturers both at home and abroad.”

Canada’s 2017 Budget eliminates tariffs on a broad range of agri-food processing ingredients and introduces changes to origin rules to allow more clothing products imported from low income countries to benefit from duty-free treatment.

Roy Maugham, Partner at UHY’s UK member firm UHY Hacker Young says: “For a post-Brexit UK, the continued appetite on the part of many countries for mutually beneficial trade deals represents a huge opportunity, but also poses a threat.”

“While a favourable attitude from some potential partners might make it easier for the British government to strike deals outside of the EU, there’s also a risk that if it fails to do so, it could be left far behind.”

AMOUNT OF CUSTOMS DUTIES COLLECTED AS A PERCENTAGE OF THE VALUE OF TOTAL IMPORTS

*Based on World Bank data – 2015, most recent available year

**Russian Federation Federal Statistics Service, 2015

Notes for Editors

UHY press contact: Dominique Maeremans on +44 20 7767 2621

Email: d.maeremans@uhy.com - www.uhy.com

Nick Mattison or Peter Kurilecz

Mattison Public Relations

+44 20 7645 3636, +44 7860 657 540 or email peter.kurilecz@mattison.co.uk

About UHY

Established in 1986 and based in London, UK, UHY is a leading network of independent audit, accounting, tax and consulting firms with offices in over 325 major business centres across more than 95 countries.

Our staff members, over 7,850 strong, are proud to be part of the 16th largest international accounting and consultancy network. Each member of UHY is a legally separate and independent firm. For further information on UHY please go to www.uhy.com.

UHY is a member of the Forum of Firms, an association of international networks of accounting firms. For additional information on the Forum of Firms, visit www.forumoffirms.org