The BRIC nations (Brazil, Russia, India and China) have increased their lending to businesses by double digits since the collapse in 2008 of Lehman Brothers while the US and many European economies have seen lending fall by double digits, threatening their economic recovery, according to UHY, the international accounting and consultancy network.

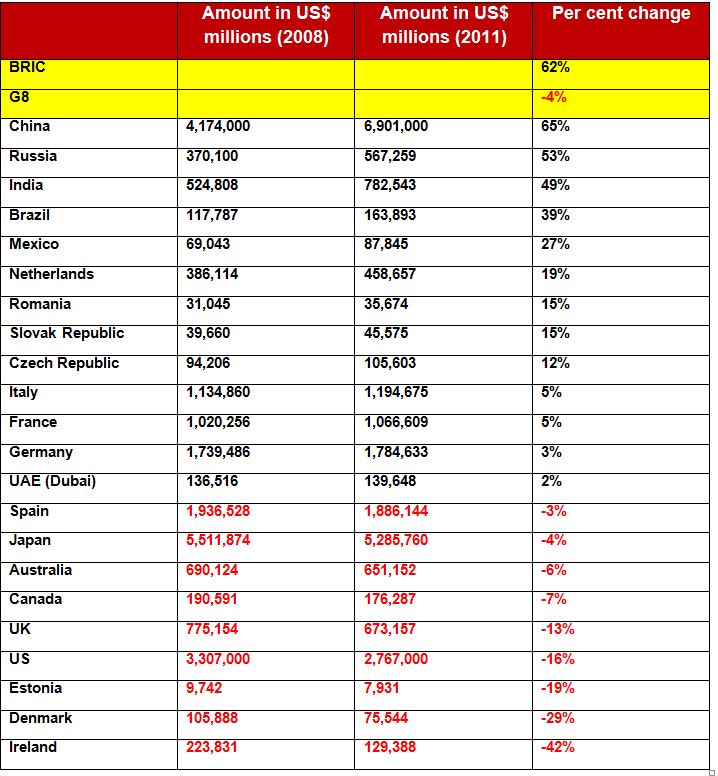

UHY research shows that banks in the BRIC nations have, on average, increased lending to businesses by 62% since December 2008 compared to banks in the G8 nations, which have, on average decreased funding to businesses by 4% over the same period.

UHY professionals studied Central Bank data on outstanding loans to businesses in 22 countries across its international network, including the G8, as well as key emerging economies, including the BRIC nations.*

According to UHY, governments in Western countries have been trying to boost lending to businesses post-Lehman Brothers as banks looked to repair their balance sheets by reducing their loan books. In many countries, the reluctance of banks to lend to businesses has been identified as an important factor inhibiting economic growth.

The country with the fastest increase in loans to businesses is China, where the amount of debt held by businesses increased by 65% since the onset of the credit crunch. Chinese banks have approximately US$6.9 trillion in outstanding loans with businesses, compared to US$4.2 trillion in December 2008.

The country which has seen the largest reduction in the value of loans to businesses is Ireland. The value of outstanding loans to businesses has collapsed by 42% since December 2008 from around US$224 billion to US$129 billion.

The research reveals, however, that some EU countries - Italy and France, for example - actually increased the value of loans to businesses, despite many of their banks being financially impaired by the sovereign debt crisis in the Eurozone.

Increase/decrease in loans to businesses since the collapse of Lehman Brothers (2008-11)

John Wolfgang, chairman of UHY comments: "The difference between the US and Europe on the one hand and the BRIC nations on the other is stark.

"The four BRIC nations have seen their lending to businesses grow at the fastest rate, while among the G8, only Russia has seen a real terms increase in business lending over the last five years.

"Lending to businesses, particularly small businesses, is seen as a key barometer of economic prosperity. Small businesses are the engine of growth for most economies, but starved of fuel in the form of credit it can be difficult for them to expand and create jobs.

"In an increasingly globalised world, if a small business cannot expand to fulfill an order, that business can be lost to a better financed overseas competitor."

He adds: "Small businesses are hugely reliant on bank financing as, unlike larger corporates, they are usually not able to raise money through bonds or share issues."

The research shows that many EU countries, including Romania, Czech Republic, Slovak Republic, the Netherlands, Italy, France and Germany have posted a significant increase in lending to businesses, despite the impact of the eurozone crisis on the liquidity of European banks.

John Wolfgang, chairman of UHY comments: "The pace of deleveraging among many European banks – in comparison with American, British and Irish banks – has been painfully slow. This probably explains why lending to businesses in countries like Italy and France has increased, albeit not in real terms.

"The deleveraging process in Europe, when it begins in earnest, will almost certainly result in a contraction in lending to businesses, which will impact economic growth. In the US, the UK and Ireland, where that process has been ongoing for several years, the ability of small businesses to access funding has become a major political issue."

He adds: "Governments can do more to encourage investment in businesses. Bank lending should not be seen as the only channel for getting finance to SMEs. Alternative forms of funding should be incentivised, such as tax breaks for private investors."

UHY research shows that, among the G8, Russia has seen the fastest increase in lending to businesses.

Nikolay Litvinov, partner of UHY Yans-Audit LLC, member firm of UHY in Russia comments: "The potential for growth of business credit in Russia remains high. Lending to businesses displayed improvement even during the global financial crisis. It is related, in many respects, to the financial stability achieved by cooperation between the state and the banking sector, as well as stable growth of Russia’s economy. Like other BRIC countries, Russia hasn’t got any preconditions for reduction in the scope of business credit."

"The recent commodities boom has insulated Russian from the full force of the global financial crisis. The Russian economy, though suffering a financial crisis in 2008/09, has recovered quite strongly since then. This has fuelled appetite for debt among Russian businesses and enabled well-capitalised Russian banks to meet that demand."

UHY research also reveals that lending to businesses in Ireland has declined by 42% since December 2008, from around US$224 billion to US$129 billion – the fastest rate among the 22 countries surveyed.

Alan Farrelly, partner of UHY Farrelly Dawe White Limited, member firm of UHY in Ireland comments: "The Irish government has pumped more than €60 billion into the banking system over the last four years. The purpose of this money was to save the banks from collapse, but now that the immediate crisis has been averted, the Government needs to ensure that more of this money finds its way into the economy."

* Figures obtained from Central Bank sources. The outstanding loan balance to non-financial corporations was taken for December of each year. For 2011, the most recent balance available has been quoted. In most cases, this is the balance as of November 2011. All local currencies were converted to US dollars using the March 15 2012 exchange rate.