Bank lending to the private sector in Europe is now on average 25% lower last year than it was before the financial crisis, hampering European economies’ return to economic growth, reveals a new study by UHY, the international accounting and consultancy network.

Bank lending to the private sector in Europe is now on average 25% lower last year than it was before the financial crisis, hampering European economies’ return to economic growth, reveals a new study by UHY, the international accounting and consultancy network.

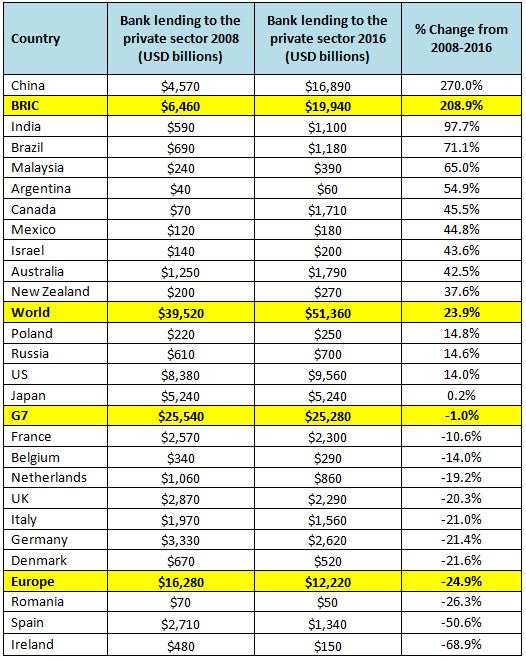

According to UHY, in 2016 a total of USD 12.2 trillion was lent to businesses in the European economies studied – down from USD 16.3 trillion in 2008.

By contrast, on average across all the 24 countries studied around the world, private sector bank lending increased by 24% over the same period in absolute terms.

UHY says that countries like Spain and Ireland which were hardest hit by the banking crisis are seeing the slowest recovery in private sector credit.

Bank lending to the private sector in Ireland is 69% below 2008 levels (USD 148 billion in 2016, down from USD 475 billion), while in Spain, it is 51% lower (USD 1.3 trillion down from USD 2.7 trillion).

Even in Germany, widely seen as the economic powerhouse of Europe, there was a 21% decrease, falling to USD 2.6 trillion last year from USD 3.3 trillion in 2008, and the UK is also down by 20.3%.

UHY says that small businesses continue to be worst affected by the ongoing bank lending slump.

This is partly due to regulators tightening banking rules in response to the financial crisis to increase the amount of capital banks need to hold to cover their liabilities. With less capital available to lend, banks tend to be more likely to focus on larger businesses that they see as having better security and repayment prospects.

Smaller businesses more negatively impacted by the fall in bank lending as they are less able than large corporates to rise cash by issuing corporate bonds as an alternative for bank loans.

Bernard Fay, Chairman of UHY, comments: “Almost a decade on from the global financial crisis, many European small and medium-sized businesses are still suffering from a shortage of credit.”

“As regulators have forced banks to shore up their balance sheets and reduce risk, many SMEs have found their access to lending severely curtailed. While some larger companies may have been able to get around this by accessing the bond market, smaller businesses are unlikely to have been so lucky.”

“Recent economic crises in some Eurozone countries and the prospect of Brexit also continue to hit lender confidence. Across Europe, this is making the road to recovery even more of an uphill journey, with even the strongest economies adversely affected.”

“Without the capex they need to fund investment, businesses will struggle to capitalise on growth opportunities or drive innovation, ultimately risking losing ground to global competitors.”

Alan Farrelly of UHY member firm UHY Farrelly Dawe White Limited in Ireland comments, “As the Irish economy rebounds and confidence returns, access to bank lending will play a critical role in helping businesses to reach their potential, both in domestic markets and on the world stage. It is important that the government and EU policymakers do all they can to ensure small businesses are not left behind.”

“However, as in other countries, initiatives to ensure that the private sector is less dependent on bank lending, for instance via alternative financing sources, are also starting to take effect. New options like crowdfunding and P2P are increasingly gaining traction.”

G7 economies lag well behind BRICs

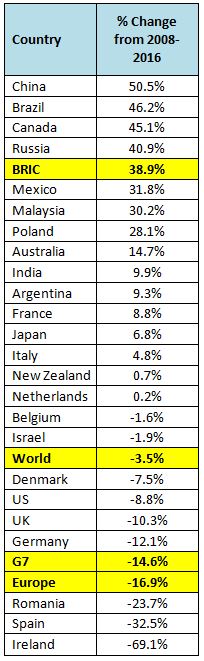

UHY adds that the G7 group of leading world economies is also lagging behind – while BRICs economies power ahead. On average, the G7 saw a 1% decrease in real terms over the period, whereas BRICs (Brazil, Russia, India, China) enjoyed an average increase of 209%.

China topped the UHY table, with bank lending to the private sector jumping 270% between 2008 and 2016.

Bernard Fay says, “It is debateable whether the appetite to lend to BRICs and other emerging economies is sustainable, as debt levels increase while economic growth slows in countries like China. Scrutiny of companies’ ability to service their borrowing will be increasingly intense.”

“What is more, if interest rates - particularly in the US - were to rise that could put the brakes on lending to both developed and emerging economies, as companies think twice about taking on more expensive borrowing.”

Oscar Gutiérrez Esquivel, managing partner at UHY member firm, UHY Glassman Esquivel y Cia, S.C., in Mexico says, “Bank lending to the private sector is vital to the economy of the country, but currently the Mexican banking system is highly concentrated in four main institutions.”

“In order to reduce costs to borrowers and stimulate lending, greater competition should be promoted by the authorities. Development banks should recover their role as main lenders to small and medium sized companies, many of which currently are not serviced by commercial banks.”

AMOUNT OF BANK LENDING TO THE PRIVATE SECTOR IN USD

BANK LENDING TO THE PRIVATE SECTOR AS A PERCENTAGE OF GDP

Notes for Editors

UHY global press contact: Dominique Maeremans, marketing and business development manager on +44 20 7767 2621,

Email: d.maeremans@uhy.com - www.uhy.com

Nick Mattison or Peter Kurilecz, Mattison Public Relations

+44 20 7645 3636, +44 7860 657 540 or email peter.kurilecz@mattison.co.uk

About UHY

Established in 1986 and based in London, UK, UHY is a leading network of independent audit, accounting, tax and consulting firms with offices in over 325 major business centres across more than 95 countries.

Our staff members, over 7,850 strong, are proud to be part of the 16th largest international accounting and consultancy network. Each member of UHY is a legally separate and independent firm. For further information on UHY please go to www.uhy.com.

UHY is a member of the Forum of Firms, an association of international networks of accounting firms. For additional information on the Forum of Firms, visit www.forumoffirms.org