Lending to key emerging economies still soaring

Smaller businesses hardest hit by “hidden credit crunch”

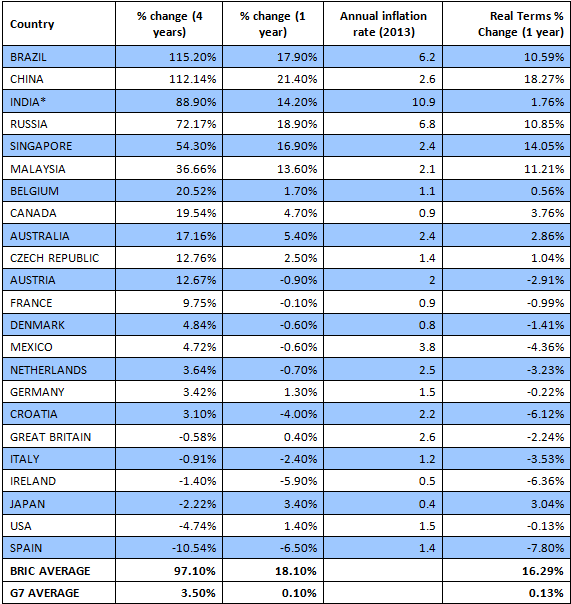

Bank lending to the private sector in the G7 group of economies has stagnated in the last year, increasing by just 0.1% in real terms, according to a new study by UHY, the international accountancy network. UHY warns that the figures show that for small businesses in particular, the credit crunch lingers on.

In the UK and US, modest expansions in lending in the last year have been wiped out by inflation. In the US there was a real terms decline in bank lending of approximately 0.1% in 2013, and of 2.2% in the UK. Over the four years since the depths of the global recession*, the volume of bank lending to the private sector in the US has declined by 4.74% in absolute terms, and in the UK by 0.58%.

UHY adds that the other countries most affected by the continued fall in bank lending since the depths of the recession were those hit hardest by the banking crisis, including Spain, Ireland and Italy. Others such as Australia and Canada, which escaped the global recession, have fared much better.

Ladislav Hornan, Chairman of UHY, says: “Nearly six years on from the start of the banking crisis, we are only now seeing modest increases in bank lending in many key global economies.”

“This continued drought in bank lending in developed economies is not just a question of appetite – it’s about regulation. Anxious to prevent a repetition of the banking crisis, regulators now require banks to hold more capital against their activities, and that is making lending more expensive.”

“While things are slowly starting to improve, and the banks are lending more, it is not enough to kick-start the growth in capital investment by businesses that so many economies need to see.”

By contrast, in many major emerging economies, bank lending continues to soar, with the so-called BRIC nations (Brazil, Russia, India, China) leading the way. Brazil has seen bank lending to the private sector jump 115% since 2009, and lending in China has risen 112%.

UHY points out that even though with the exception of China, inflation in the BRIC economies was high, lending growth remained very substantial even in real terms (see table below). The average lending growth across all four countries in 2013 was 18.1%. In China, lending expanded by 21% in the last year, and inflation was relatively moderate at 2.6%.

Adds Ladislav Hornan: “Bank lending in emerging markets, which has surged since the global recession, still shows no signs of abating. While typically banks have been comfortable with their emerging markets lending because overall levels of indebtedness are relatively low, there are now growing concerns about whether debt levels in China are sustainable, and what the impact on other countries will be should there be a credit crisis there.”

UHY explains that, as many of the world’s leading economies fell into recession, several of the key emerging economies saw robust growth. A well as output increasing, fiscal stimuli such as the US Federal Reserve’s Quantitative Easing (QE) programme pushed bond yields to ultra-low levels, prompting many investors to seek better returns in the emerging economies. However, some emerging economies could be affected by the Federal Reserve now winding down the QE asset purchase programme (known as ‘tapering’).

Eric Waidergorn of UHY Moreira – Auditores, a member of UHY says, “Increased lending in Brazil helped to prevent an economic crisis in the last few years, but the short-term prospects for the economy are not yet certain.”

“A major issue is whether Brazilian businesses will be able to manage the levels of debt they have taken on as Brazil’s economy slows. There are also concerns being voiced over the sustainability of China’s credit levels. A crisis there would have a serious impact on Brazil since it is such an important market for us.”

Smaller businesses hardest hit, as funding problems continue despite recovery

UHY says that the continued slump in lending in developed economies has hit smaller businesses the hardest, as bigger companies have been able to access the bond markets to fill the gap in funding.

In the UK, lending through corporate bonds has increased by 35% over the last four years, while in the US it has increased by 44%, and in France by 35%.

Says Ladislav Hornan, “Corporate bonds have long been a good way for larger companies to get the funding they need, but as bank lending has dried up, they have now become a vital tool. Smaller businesses don’t have the same luxury, as issuing bonds can be quite costly in terms of advisory and other fees.”

“Efforts to create a bond market to help SMEs, while welcome, will come far too late for this economic cycle.”

He adds, “Although the recovery is taking now hold in many developed economies, problems over bank funding are far from over. Many banks are still unable to lend, especially to smaller businesses, leaving them facing a hidden credit crunch.”

UHY says that the companies find that available bank finance is too expensive, considering lending margins to be too high. This leaves businesses struggling to find appropriate finance to deal with cash flow problems or make capital investments.

Laurence Sacker, Partner of UHY Hacker Young in the UK says, “Demand for loans is increasing, but the banks are generally not granting new requests unless they are from existing customers with a good track record and security. That’s leaving many smaller businesses that have struggled through the recession but are now on a more stable footing, still out in the cold.”

UHY adds that although new, alternative forms of finance such as crowd-funding have been gaining traction, these are unlikely to provide an adequate solution for most established businesses. Invoice financing, which is growing in popularity, may be more appropriate, however it is unlikely to be able to fill the gap.

BANK LENDING TO PRIVATE SECTOR BY COUNTRY

*Data period: 1st January 2009 – 31st December 2013. Private sector lending includes lending to businesses and households, excluding credit through debt securities such as bonds.

** Source: World Bank

For additional information about this article please download the PDF below.

Trends in Global Bank Lending in the Post - Financial Crisis Era

Trends in Global Bank Lending in the Post - Financial Crisis Era